Some Of Bank Certificate

Wiki Article

Some Ideas on Bank Statement You Should Know

Table of ContentsThe smart Trick of Bank Code That Nobody is Talking AboutWhat Does Bank Code Mean?7 Simple Techniques For Bank AccountNot known Facts About Bank Reconciliation

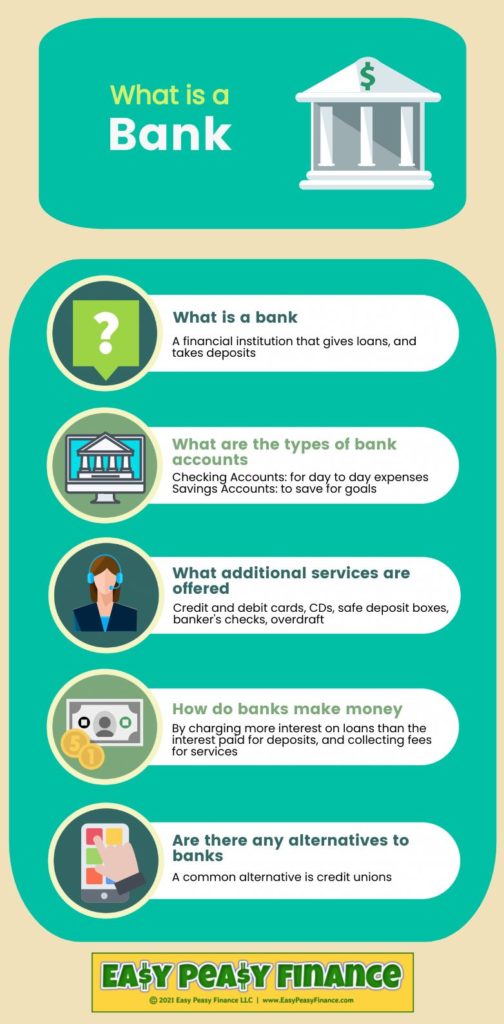

You can additionally save your cash as well as earn rate of interest on your financial investment. The money saved in most bank accounts is federally insured by the Federal Down Payment Insurance Corporation (FDIC), approximately a limitation of $250,000 for specific depositors and also $500,000 for jointly held deposits. Banks additionally offer credit scores opportunities for people and companies.

Financial institutions make a profit by billing more interest to borrowers than they pay on interest-bearing accounts. A financial institution's dimension is identified by where it is located as well as who it servesfrom little, community-based institutions to big industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured industrial financial institutions in the USA as of 2021.

Conventional financial institutions use both a brick-and-mortar place as well as an on the internet presence, a new fad in online-only financial institutions arised in the early 2010s. These banks commonly provide consumers higher rate of interest as well as lower charges. Ease, rate of interest rates, as well as fees are some of the elements that help consumers decide their favored financial institutions.

The Basic Principles Of Bank Reconciliation

The governing environment for banks has actually given that tightened up substantially as an outcome. United state banks are regulated at a state or nationwide degree. State financial institutions are controlled by a state's department of financial or department of financial establishments.

A area financial institution, for example, takes deposits and also provides in your area, which can offer a more tailored financial connection. Select a convenient area if you are selecting a bank with a brick-and-mortar area. If you have a financial emergency, you don't want to need to take a trip a long range to obtain cash money.

The Best Guide To Banking

Some banks also provide smart device applications, which can be useful. Check the fees related to the accounts you intend to open. Financial institutions bill interest on lendings along with monthly upkeep charges, overdraft account fees, and also wire transfer costs. Some huge financial institutions are relocating to finish over-limit costs in 2022, so that can be an important factor to consider.Financing & Development, March 2012, Vol (bank code). 49, No. 1 Institutions that compare savers as well as consumers aid ensure that economic situations function smoothly YOU have actually got $1,000 you do not require for, claim, a year and also intend to gain income from the money until after that. Or you wish to get a home and need to borrow $100,000 as well as pay it back over 30 years.

That's where banks can be found in. Although banks do several points, their primary function is to absorb fundscalled depositsfrom those with money, pool them, as well as provide them to those who require funds. Banks are intermediaries between depositors (that lend cash to the financial institution) get more and also customers (to whom the bank offers cash).

Down payments can be readily available on demand (a monitoring account, for example) or with some limitations (such as savings as well as time deposits). While at any provided moment some depositors need their money, a lot of do not.

Bank Account Number - The Facts

additional resourcesThe process entails maturity transformationconverting short-term liabilities (deposits) to lasting properties (car loans). Financial institutions pay depositors less than they obtain from borrowers, which difference accounts for the bulk of financial institutions' earnings in a lot of countries. Banks can match traditional down payments as a source of funding by directly borrowing in the cash and also capital markets.

Financial institutions keep those needed books on deposit with central financial institutions, such as the U.S. Federal Book, the Bank of Japan, and the European Central Bank. Financial institutions produce cash when they lend the remainder of the cash depositors provide. This cash can be used to purchase products and also solutions and also can find its means back into the banking system as a down payment in another financial institution, which then can offer a fraction of it.

The dimension of the multiplierthe amount of cash produced from a first depositdepends on the amount of cash banks should go on get (bank). Financial institutions likewise offer and also reuse excess money anchor within the economic system and develop, distribute, and trade securities. Financial institutions have a number of ways of earning money besides stealing the difference (or spread) in between the rate of interest they pay on deposits and borrowed cash and also the rate of interest they collect from customers or safeties they hold.

Report this wiki page